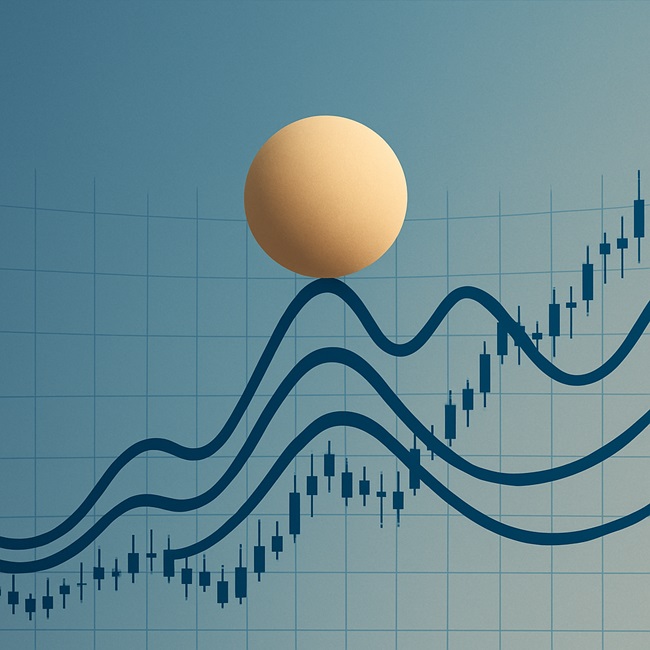

Crypto & Web3 • DeFi • Algorithmic Trading

UpLift – Crypto Research & Risk Intelligence

We partner with funds, family offices, and venture capital on bespoke research, support DeFi protocols with parameter & risk modelling, and enable discretionary traders with data, backtesting, and execution.

Our team are native crypto users with actuarial backgrounds and expertise in machine learning, finance, and blockchain. With over a decade of experience, we run on-chain and off-chain strategies with deep knowledge across many protocols.

Trusted by

Limited-time

Special Offer: 5 Hours of Free Consulting

We are offering 5 complimentary consulting hours to select funds, protocols, and trading teams. This is our way of demonstrating the depth of our expertise, building stronger networks, and continuing our own learning and development alongside serious builders and investors.

Our team of actuaries and machine learning specialists typically command premium rates for risk modelling, data research, and strategy design-work that blends quantitative finance with deep crypto-native experience.

Services We Offer

We bring actuarial rigor and machine learning to investing, DeFi, and trading.

Pick your profile and explore the tailored support we provide.

Funds / Family Offices / VCs

Clear analytics to evaluate opportunities and manage portfolio risk.

• Deal screening & tokenomics insights

• Market & liquidity benchmarking

• What-if scenarios & stress testing

• Independent model & data validation

• Token unlocks & activity tracking

• Market & liquidity benchmarking

• What-if scenarios & stress testing

• Independent model & data validation

• Token unlocks & activity tracking

DeFi Protocols

Data-driven parameter design and health monitoring for resilient systems.

• Risk frameworks & parameter calibration

• Stress tests & sensitivity analysis

• Incentive & liquidity modeling

• Oracle/MEV monitoring & anomaly flags

• Treasury & runway scenario modeling across market regimes

• Stress tests & sensitivity analysis

• Incentive & liquidity modeling

• Oracle/MEV monitoring & anomaly flags

• Treasury & runway scenario modeling across market regimes

Discretionary Traders

Research infrastructure and analytics that turn data into performance.

• Data pipelines & backtesting

• Signal discovery & validation

• Portfolio sizing & risk overlays

• Execution & slippage analytics

• Live monitoring & model signal alerts

• Signal discovery & validation

• Portfolio sizing & risk overlays

• Execution & slippage analytics

• Live monitoring & model signal alerts

Our Team

Given the adversarial nature of the crypto space, we share broad experience, roles, and public work — not exact identities.

More detail will be shared privately as we engage.

Xan

Actuary | Quant Research | SalesActuarial-trained quant with trading experience across equity derivatives, fixed income, and digital assets. Previously led an equity-derivatives desk at a tier-1 global bank and later ran systematic strategies at a hedge fund. Experience spanning pricing, risk, and execution across options, rates, and crypto-linked markets.

Jazz

Actuary | Quant ResearchActuarial-trained data scientist and ML engineer focused on reliable data pipelines and production-grade research tooling. Experience spans insurance innovation across pricing, claims, and automation (RPA & ML), with a track record of turning messy datasets into reproducible backtests and decision tools for systematic strategies.

Ava

Charted Accountant | Quant ResearchAccounting-trained quant and research analyst focused on parameter modelling, scenario analysis, and incident/post-mortem reviews. Background across financial reporting, controls, and treasury; brings a controls-first approach to valuation, risk metrics, and investor-grade reporting, translating analysis into crisp decisions.